26 Oct What Do Declining Home Prices and Higher Interest Rates Mean for Investors?

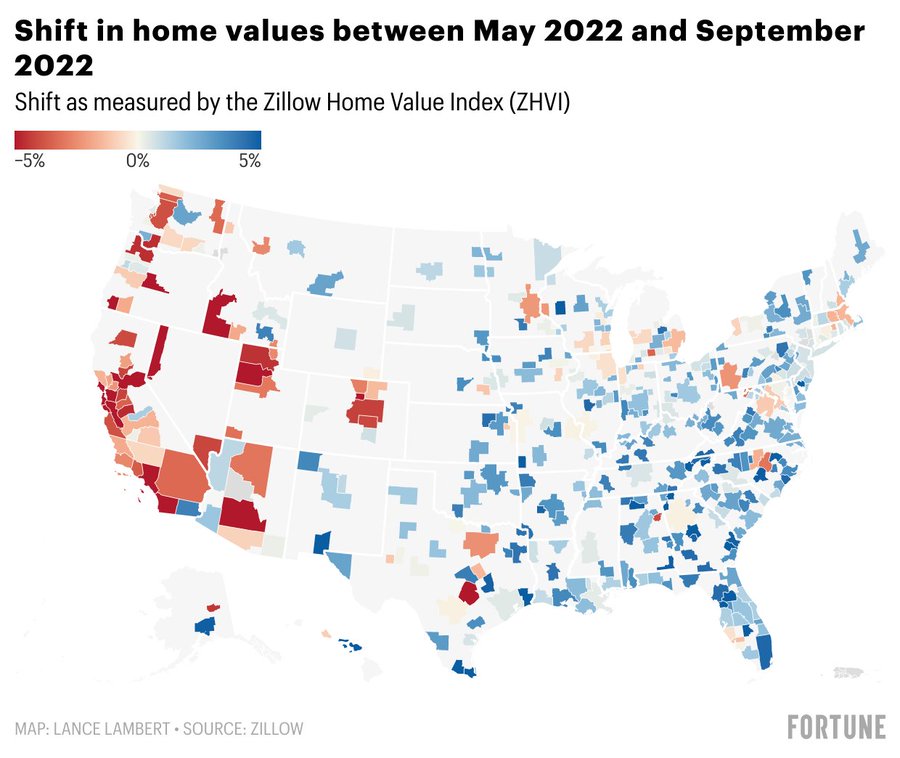

Home price growth slowed by the largest amount on record in August 2022. [Nationwide price change chart courtesy of Lance Lambert of Fortune using data from Zillow.]

Across the country, residential home prices are up year-over-year yet decreasing month-over-month. The S&P CoreLogic Case-Shiller Home Price Index showed that home prices in August 2022 were up 13% over August 2021. The July report showed that prices were up 15.6% year over year. That 2.6% decline from July to August is the largest monthly drop in the history of the index, which began in 1987.

The Mortgage Bankers Association just reported on October 26, 2022 that mortgage applications were down 42% as compared to a year earlier. Mortgage interest rates are the highest in 21 years, Demand for mortgages is the lowest since 1997.

Inventory levels have been increasing across the country. Nationally, there is about a 3.2-month supply of homes. A 5 to 7 month supply is considered a balanced market. Technically, many areas are still in a seller’s market yet prices are dropping and days on market are increasing.

Median rents in the nation’s 50 largest cities fell by about $10 in August 2022, according to Realtor.com data. However, a supply and demand imbalance could help push rents up more in 2023. With fewer active homebuyers, that will increase the number of people looking to rent. The Federal Reserve Bank of Dallas, using data from the government’s Consumer Price Index, projects that year-over-year rent increases will go from 5.8% in June 2022 to 8.4% in May 2023. Historically, rents increase 3 to 4% per year, with slight declines during recessions.

So, what does this all mean for investors? It’s true that across the board, there may be more sellers willing to entertain an offer below the asking price. We’ll explore the implications of the market shift on wholesalers, landlords, and flippers.

- Wholesalers. When cash and mortgage loans are abundant, wholesalers can thrive. Most wholesale deals involve a cash buyer taking over the contract from the wholesaler and buying the property from the seller. With fewer cash buyers, wholesalers may have trouble finding buyers to take over their contracts. Also, with home prices going down, cash buyers may negotiate the wholesaler’s assignment fee lower. It is possible that some sellers will consider selling with a wholesaler if they are unable to sell their house after many weeks.

- Landlords. Landlords can thrive in any market if they buy right and ensure that they have sufficient positive cash flow. The rising mortgage interest rates don’t hurt landlords as much because rents tend to rise with inflation. In fact, rent increases account for a sizable portion of inflation. With more sellers willing to drop their price because of fewer homebuyers, landlords can be more selective in finding deals. It’s all about the math. Being a landlord can be highly predictable. You can calculate the purchase price, monthly mortgage payment if using financing, renovation expenses, carrying costs, market rents, and vacancy rate. If after all those calculations you have at least $200 per unit (preferably more) in positive cash flow, then consider doing the deal. The bottom line is that in most market areas, rents are still rising and property prices are falling, which is music to landlords’ ears.

- Flippers. A lot of whole=tailers (people who flip without doing any work on the house) and house flippers (those who fix and then flip) are facing serious headwinds. Higher days on market, fewer buyers, increasing inventory, higher materials costs, and more buyers terminating their contract are all problems for flippers. I personally know some flippers with full-time contractors on staff who are dealing with cash-flow crunches. There are four real estate market cycles: 1) The rising market, 2) the peak market, 3) the declining market, and 4) the trough market. Flippers tend to do well in the rising market and the early part of the peak market. When the market rolls over, many flippers see their profit margins evaporate.

One other problem for investors is the tightening by banks. Money is not as cheap nor as easy to get as it was just six months ago. Investors who have substantial cash reserves or access to capital will thrive as the market shifts as long as they negotiate great deals. New millionaires are created in economic downturns. I want you to be one of them!

Tai DeSa is a graduate of The Wharton School of the University of Pennsylvania. He became a full-time real estate investor in 2004 after serving in the U.S. Navy. Tai has made colossal mistakes in investing (and learned some things along the way). He has helped hundreds of homeowners avoid foreclosure through successful short sales. Check out Tai’s books on Amazon.com. Tai may be available for coaching and speaking engagements on a variety of real estate topics. Send an email to tai@investandtransform.com.

No Comments