06 Nov Are House Flippers in Big Trouble With This Market Shift?

This week a house flipper backed out of their contract for a cash purchase, willingly forfeiting their hefty deposit.

Another flipper ran out of money and has been laying off their full-time contractors.

A real estate investor has been denied additional financing from their bank, leaving them to run up their high-interest credit cards to finish a project.

A private lender complained that the flipper they loaned money to has been giving them the runaround with repayment of their loan.

Another flipper has been losing their patience with their real estate agent, as there haven’t even been any showings on their latest listing.

A wholesaler who normally assigns deals to flippers has been unable to assign a single deal in three months.

These situations are playing out across America right now, as mortgage interest rates have increased 2% in the past three months and 4% year to date. Banks are tightening their lending standards. Private lenders are hitting pause on the flow of money. Days on market are going up. Price reductions are necessary in many cases. Open Houses don’t attract many people. Builders are seeing buyers back out of deals. The Federal Reserve keeps raising rates. The yield curve has been inverted for months. The 10-year Treasury yield is over 4%. People are nervous.

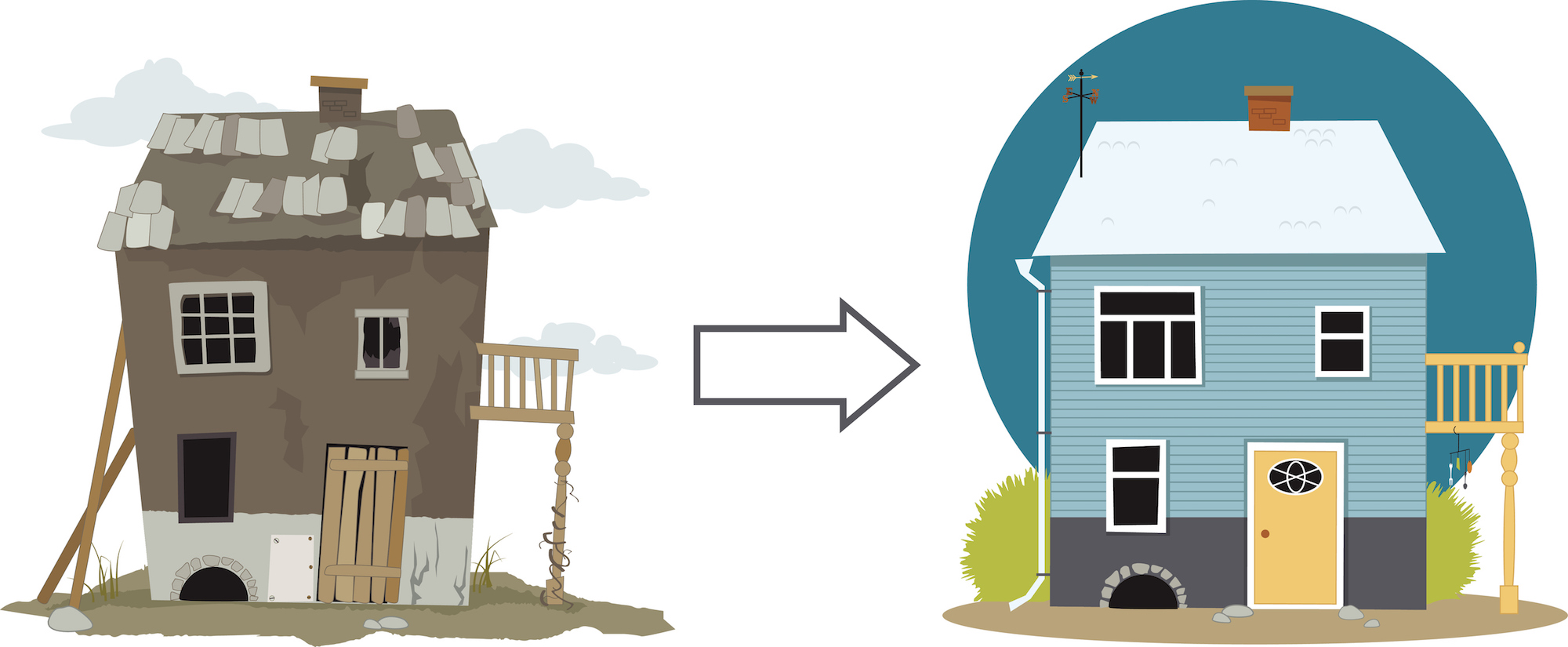

There are four real estate markets. Read our article on the strategy for each. Flippers (and the wholesalers who often depend on flippers) typically come under extreme pressure in declining markets. We are about 13 years into a 5 to 7 year cycle. Many real estate investors have not been through a housing decline. The market ran up historically fast since 2020, and now it needs to correct.

Whenever you know which market you are in, you need to prepare for the next one. Unfortunately, many people assume that the current market will continue indefinitely. Many flippers and wholesalers will feel pain in this declining market if they don’t adjust quickly or if they are overleveraged. The flippers especially can feel pain, as they typically have far more money invested in real estate than a typical wholesaler.

So, what can real estate investors do here?

- Be a landlord. Consider renting out your house(s). Now, many times a flipper will improve a house higher than the standard for a rental. For example, a landlord may be satisfied with older light fixtures, Formica countertops, and used white appliances. A flipper may go for new fixtures, granite counters, and new stainless steel appliances. Also, a flipper may have short-term, high-interest financing in place like a hard money or private loan. Nevertheless, if a flipper can’t sell a house now for the price they need to, they can switch gears for a while and rent out the house. A silver lining is that long-term capital gains tax is less than short-term capital gains tax. In other words, instead of paying their ordinary income tax rate, a flipper may only pay 15% capital gains tax if they sell their investment property after owning it at least a year.

- Lower your expenses and then lower them even more. Cut out the fat. Get lean. When times are good, entrepreneurs tend to add on subscriptions, buy doodads, and finance things like cars, trucks, and tools. If you have people on payroll, you have to take a hard look at cutting back hours or personnel. Sometimes you have to lay off one person to save the remaining jobs. If you have to do some of the work yourself instead of hiring a contractor, do it for now.

- Pay off your high-interest debt now. If you have to, sell an asset for less than you hoped. Holding on to a finished flip project hoping for an above-market price is foolish, especially with heating season here. Work with your listing agent to get ahead of the market by pricing aggressively. Take the proceeds and pay down debt.

- Build a moat to protect your business. Set aside cash, perhaps up to 6 months’ worth of operating expenses. That cash can come in handy if there is a screaming hot deal that comes across your desk.

- Lower your After Repair Value. Whatever you think the ARV is based upon the past six months, reduce it by five figures. If you think the ARV on a potential deal will be $300,000, lower it to $270,000. Even if the comparable sales seem to support $300,000, cut it by 10% or more.

- Revisit your Maximum Allowable Offer criteria. In addition to cutting back your ARV, be more strict with your offer criteria. You’ll end up making lower offers than before. Your money is made when you buy, so instead of buying low, buy really low.

- Don’t flip luxury homes for now. A luxury home in many markets is a property with an ARV over $500,000. In economic downturns, high-priced homes typically go down in value before mid-level or entry-level homes. And they go down more in value percentage-wise. If you’re buying a house for $500,000, putting $150,000 into renovations, and then hoping to sell it for $800,000, what you have is a lot of money hanging out there. You could buy three to four entry-level homes in many markets for the same amount of money.

- Shop around for financing, Realtors, contractors, and other vendors. Many flippers have their guy or their gal. They work with the same team members. However, in an economic downturn, you need to price shop more. Or, get team members to shave a little off their pricing too. We’re all in this together.

Real estate is not a zero sum game. Someone doesn’t have to lose when you win. Even when you sell a property for less than you initially planned, you can win by redeploying the the capital you receive into something better. When you have a moat around your business, you’ll sleep better. And somehow, more lucrative deals will find their way to you when you’re flush with cash savings.

There is no need to be stressed over a shift in the market. After all, shifts are to be expected! They are part of the normal order of things. In the long run, real estate values and rents go up. It just so happens that after values run up, they need to correct before running up again. Sometimes you have to lose on an individual deal to gain the knowledge to win over the long run. I made dozens of mistakes in the Great Recession, which helped me learn how to build wealth and cash flow thereafter. That has made all the difference.

Tai DeSa is a graduate of The Wharton School of the University of Pennsylvania. He became a full-time real estate investor in 2004 after serving in the U.S. Navy. Tai has made colossal mistakes in investing (and learned some things along the way). He has helped hundreds of homeowners avoid foreclosure through successful short sales. Check out Tai’s books on Amazon.com. Tai may be available for coaching and speaking engagements on a variety of real estate topics. Send an email to tai@investandtransform.com.

No Comments