07 Feb What Every House Flipper Needs to Know About Taxes

A first-time house flipper spent 46 weeks renovating a house. He listed it for sale and soon received a strong offer from a buyer. The flipper was stunned when I said that he would have to pay taxes on his profit. I told him three things:

1.) He should negotiate with the buyer to have the closing occur a year and a day after he bought it to reduce his taxes down to just 15% of the profit,

2) He was fortunate to have a profit because not all flips make money, and

3) He needed to hire and consult an accountant.

After chatting with an accountant, the flipper did indeed have the closing a year and a day after buying the house. Professional flippers would not have waited a year to sell, yet given the circumstances this novice flipper did the right thing.

Here are the main things every flipper should know about taxes:

- Flipping (even if it’s your first one) is a business. The IRS considers your profit to be active income. You pay taxes in the same way as if it were a job or business. That includes federal and any applicable state income taxes, plus self-employment taxes. Self-employment taxes are 15.3%.

- If you sell the property in less than a year after buying it, the profit is considered ordinary income. Ordinary income is any income earned by a business or person taxable at marginal tax rates.

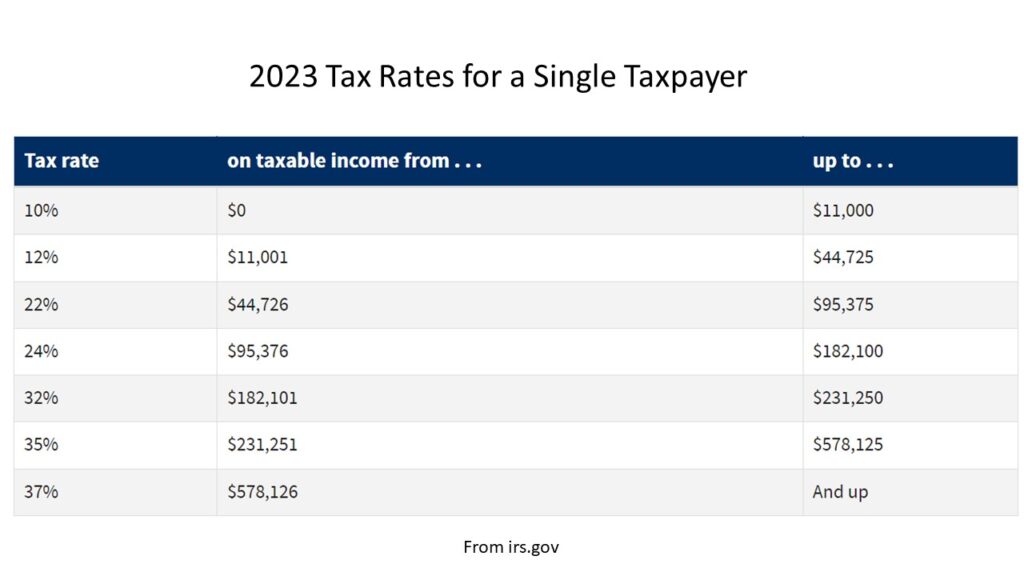

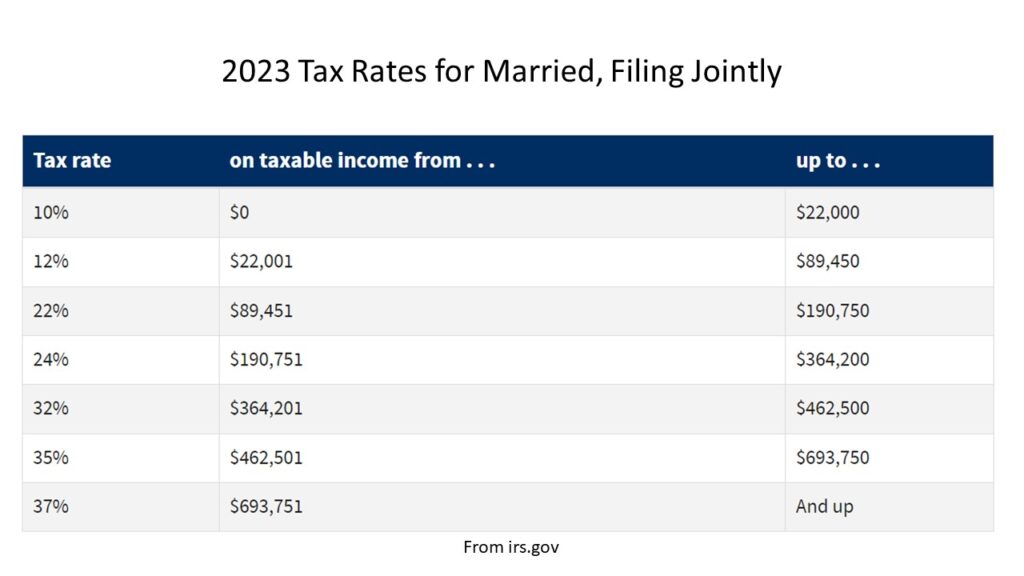

The individual tax brackets for 2023 are:

If you own the asset more than one year, the profit is treated as a long-term capital gain instead of a short-term capital gain (ordinary income). That’s a good thing for you. Most people would only pay a 15% tax on the long-term capital gain. If you are in the 32% tax bracket and sold an asset in less than a year, then you’d pay 32% of the profit in tax.

Here are the capital gains tax rates:

Per the IRS, your capital gains tax is 0% if your taxable income is less than or equal to:

- $44,625 for single and married filing separately,

- $89,250 for married filing jointly and qualifying surviving spouse; and

- $59,750 for head of household.

A capital gains rate of 15% applies if your taxable income is:

- more than $44,625 but less than or equal to $492,300 for single,

- more than $44,625 but less than or equal to $276,900 for married filing separately,

- more than $89,250 but less than or equal to $553,850 for married filing jointly and qualifying surviving spouse; and

- more than $59,750 but less than or equal to $523,050 for head of household.

A capital gains rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. The ultra-wealthy may pay 20% capital gains tax (although that is better than the 37% marginal tax rate they pay for ordinary income). Check out our blog on how to reduce your capital gains tax.

If you’re a good flipper, you’ll sell the property in only a few months and recycle that money into the next deal. Paying an ordinary income tax rate is the cost of doing business. For skilled flippers, it makes sense to complete as many projects as possible in the same year with the same money.

Can you pay $0 in capital gains tax on a flip?

Yes, there are three ways to do it. Each one comes with a catch.

- You sell your primary residence after living in it at least 2 years. This is known as the IRS Section 121 Exclusion. If you lived in a house for at least two of the past five years (and they can be non-consecutive years), then the first $250,000 of capital gains is tax-free ($500,000 if married, filing jointly). There are people who will buy a fixer-upper, move in and renovate it slowly, and then sell it after a couple of years. That is what I call a slow flip. It can be quite lucrative if you don’t mind moving every handful of years.

- If you have a short-term capital loss (maybe from day trading losses or a loss on the sale of a previous house flip), you can offset your short-term capital loss with a short-term capital gain. For example, let’s say you lost $90,000 in day trading stocks or cryptocurrency. You then make $90,000 flipping a house in a few months. You won’t owe any short-term capital gains tax because of your prior loss. The same applies regarding long-term capital losses and long-term capital gains.

- You can do a slow flip of an income property and acquire a like-kind property via an IRS Section 1031 tax-deferred exchange. You could buy a rental property and own it for a few years. Then you sell it and use the proceeds to buy another rental property. The proceeds from the sale must go through a qualified intermediary. If your business is flipping vacant houses, you obviously cannot do 1031 exchanges. Check out our blog on how to use a 1031 exchange to indefinitely defer capital gains taxes.

What tax deductions are available for flippers?

Here are some ways to maximize your tax benefits to minimize your taxes:

- Closing costs. This includes title insurance, transfer taxes, fees, and realty commissions.

- Loan costs. This includes interest, fees, and appraisal costs.

- Construction materials. Whether it is drywall, sinks, cabinets, light fixtures, nails, paint, or all of the above, you can deduct it.

- Labor. If you pay contractors, that amount is deductible. You can also deduct the labor costs for administrative work associated with the sale. If you performed the work yourself, your hours are not deductible.

- Utilities. This includes the utilities plus the cost of turning on the service.

- Property taxes. You can deduct the taxes that are pro-rated for your time of ownership.

- Professional fees. You can deduct legal and accounting fees. If you hired an architect, appraiser, surveyor, or other professional, those fees are deductible.

- Travel. You can track mileage on business travel (65.5 cents a mile for 2023; 67 cents a mile for 2024). I use the MileIQ app. Or you can deduct the actual vehicle expenses, such as a lease payment, maintenance fees, and gasoline costs.

- Depreciation on equipment. Your big tools or heavy equipment could be depreciated on your tax return.

When should the taxes on flips be paid?

You pay taxes after a successful sale. How long after? If you’re making more than $1,000 a year in flip profits (and I hope you are!), then technically you should prepay some of the taxes via quarterly payments to the IRS and your state’s Department of Revenue (if applicable). When you file your tax return by April 15th, you’ll pay any additional tax owed or be eligible for a tax refund if you had an overpayment. Some flippers don’t bother with quarterly tax payments, yet they may pay a penalty later.

I know flippers who did not set aside any money for taxes. They spent all of their profits on other things. When April 15th rolled around, they had a huge tax bill and not enough cash to pay it. That’s not wise. When you make quarterly tax payments, you prevent the future shock of not having enough money to pay your big tax bill.

One last thing – not every flip project makes money. If you made money, congratulations! I hope you learned a lot from your project. Don’t be upset with having to pay taxes, because that means you actually made money!

Consult with your tax advisor to determine what is best for your situation.

Check out my latest book, How to Become a Wealthy Real Estate Investor.

Tai DeSa is a graduate of The Wharton School of the University of Pennsylvania. He became a full-time real estate investor in 2004 after serving in the U.S. Navy. Tai has made colossal mistakes in investing (and learned some things along the way). He has helped hundreds of homeowners avoid foreclosure through successful short sales. Check out Tai’s books on Amazon.com. Tai may be available for coaching and speaking engagements on a variety of real estate topics. Send an email to tai@investandtransform.com.

No Comments